Hard Money Atlanta Can Be Fun For Everyone

Table of Contents7 Simple Techniques For Hard Money AtlantaNot known Details About Hard Money Atlanta Some Known Factual Statements About Hard Money Atlanta The Basic Principles Of Hard Money Atlanta

In the majority of areas, rate of interest prices on hard money lendings range from 10% to 15%. On top of that, a consumer may need to pay 3 to 5 points, based on the overall loan amount, plus any type of appropriate evaluation, assessment, and also management costs. Many tough cash lending institutions call for interest-only settlements throughout the brief period of the finance.Difficult money lenders make their cash from the rate of interest, points, and costs credited the debtor. These loan providers want to make a quick turn-around on their investment, thus the greater passion rates and shorter terms of tough cash financings. A hard cash financing is a great concept if a customer requires money quickly to purchase a building that can be rehabbed as well as flipped, or rehabbed, leased and re-financed in a relatively brief period of time.

They're additionally helpful for capitalists who do not have a great deal of security; the property itself ends up being the collateral for the loan. Tough money fundings, however, are not perfect for traditional house owners intending to fund a residential or commercial property lasting. They are a helpful tool in the capitalists toolbelt when it comes to leveraging cash to scale their business.

For personal capitalists, the best component of obtaining a hard cash lending is that it is less complex than getting a standard mortgage from a bank. The approval procedure is generally much less extreme. Banks can request a virtually endless series of files as well as take numerous weeks to months to obtain a finance accepted.

How Hard Money Atlanta can Save You Time, Stress, and Money.

The primary function is to ensure the debtor has a leave strategy and isn't in monetary spoil. Many hard cash loan providers will function with individuals who do not have excellent credit score, as this isn't their greatest issue - hard money atlanta. The most vital point hard cash lending institutions will look at is the financial investment building itself.

They will certainly also review the debtor's scope of job and budget to guarantee it's reasonable. Sometimes, they will certainly stop the procedure since they either believe the building is as well far gone or the rehabilitation budget is impractical. Lastly, they will certainly review the BPO or evaluation and the sales and/or rental compensations to guarantee they concur with the evaluation.

There is an additional advantage developed right into this procedure: You get a second set of eyes on your bargain and one that is materially invested in the job's end result at that! If a deal is bad, you can be relatively certain that a tough money loan provider will not touch it. Nonetheless, you need to never use that as a reason to abandon your very own due persistance.

The best place to try to find difficult cash lending institutions remains in the Bigger, Pockets Hard Money Lending Institution Directory Site or your neighborhood Real Estate Investors Association. Keep in mind, if they've done right by another financier, they are likely to do right by you.

3 Simple Techniques For Hard Money Atlanta

Check out on as we review tough money car loans and why they are such an attractive alternative for fix-and-flip genuine estate financiers. One significant benefit of tough cash for a fix-and-flip financier is leveraging a trusted loan provider's reputable capital and also speed.

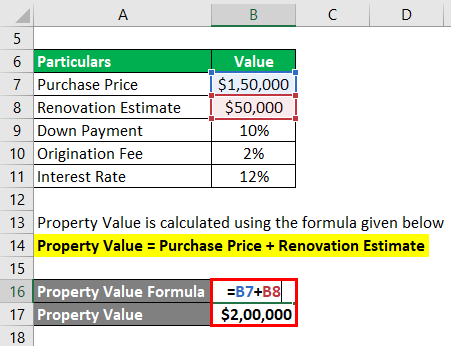

You can tackle jobs incrementally with these tactical car loans that enable you to rehab with just 10 - 30% down (depending upon the lender). Difficult money fundings are normally short-term financings utilized by actual estate financiers to money fix as well as flip view it now residential or commercial properties or various other property financial investment deals. The building itself is used as security for the loan, and the top quality of the real estate deal is, as a result, more vital than the customer's creditworthiness when certifying for the financing.

However, this also implies that the danger is higher on these finances, so the rates of interest are usually greater too. Fix and also turn capitalists pick tough cash since the marketplace doesn't wait. When the chance emerges, as well as you prepare to get your project right into the rehabilitation stage, a difficult money car loan gets you the cash straightaway, pending a fair assessment of business deal.

Getting The Hard Money Atlanta To Work

Intent and also residential property documents includes your detailed scope of work (SOW) as well as insurance policy. To assess the home, your loan provider will certainly consider the worth of equivalent homes in the location as well as their forecasts for development. Complying with a quote of the residential property's ARV, they will certainly money an agreed-upon portion of that worth.

Comments on “More About Hard Money Atlanta”